Russia vs. EU: between political tensions and economic opportunities

Drawing perspectives is not an easy task in a pandemic era characterized by a high level of unpredictability. Who could imagine that an unknown virus would make simple traveling between Russia and the EU nearly impossible for a few months, rebuilding to a certain extent a form of iron (health) curtain just thirty years after the fall of the Soviet Union? Although the pandemic has fueled additional volatility into our lives, this period has also confirmed some of the key trends that are likely to shape the future of this economic relationship.

It is the politics, stupid!

“It is the politics, stupid!” to paraphrase the famous line from the American 1992 elections (“it is the economy, stupid!) emblematic of the 1990s “end of History” paradigm. As far as the relationship between Russia and the EU is concerned, politics is now influencing business more than the contrary. At least since the 2014 Ukrainian crisis, which has proved that both sides were ready to sacrifice obvious economic interests to political goals. Sanctions have replaced diplomacy and this trend is strengthening, with the EU having adopted its own Magnitsky-style act to impose sanctions in relation with human rights abuses. This makes long-term economic ties quite vulnerable to political events, internal developments and international tensions.

This evolution is exacerbated by the growing role played by the Russian state in the country’s economy. State-owned companies are not only key actors in “strategic” sectors like energy or infrastructures, their involvement now extends to areas like banking, agriculture or IT. The structure of real incomes confirms this tendency: the part of income derived from entrepreneurial activities went down from 15.4% in 2000 to 5.2% in 2020 whereas the proportion of income deriving from social payments rose from 13.8% to 20.1%, which is even higher than the level reported in 1985 (16.3%). This should be put in the context of a shift in macroeconomic policies after the global financial crisis of 2008 favouring the maintenance of macroeconomic stability over the generation of high growth rates.

The EU and Russia are drifting apart

Just when the economy is getting increasingly political, “there are no relations with the EU as an organization” noted Russian Foreign Minister Sergey Lavrov on March 23rd. This echoed the statement made the day before by European Council President Charles Michel about “the EU-Russia ties [being] at a low point”. One could argue about the roots and responsibilities behind this divide. The fact is that over the next decade, economic cooperation will be framed in the context of bilateral talks with European countries. There is room for further economic cooperation on global public goods like climate change, technology or health. The European Green Deal is a great opportunity to develop economic partnerships for a more sustainable development. But the EU future carbon border adjustment mechanism may also create tensions with Russian exporting companies. The controversy about Sputnik V vaccines shows that finding areas for “enhanced coordination” has become quite a challenge. Even a very hypothetical withdrawal of EU sanctions is unlikely to boost trade and FDIs from Europe as long as US sanctions remain in place, as per the recent example of Iran.

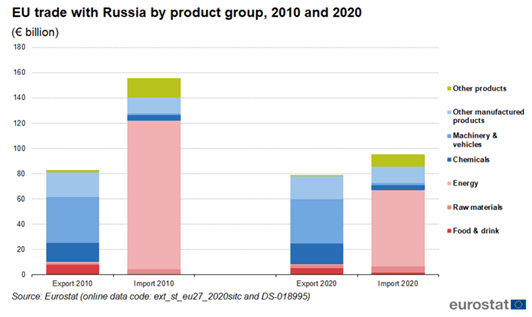

Figura 1 - Commercio bilaterale UE-Russia

Russia’s Pivot to the East

It is not a coincidence if M. Lavrov was in China when he made the aforementioned comment about the EU. Nature abhors a vacuum. While the share of the EU in Russia’s foreign trade declined from 49.4% in 2013 (before the sanctions) to 41.6% in 2019 and to 38.5% in 2020, the share of China went up steadily from 10.5% in 2013 to 16.7% in 2019 and 18.3% in 2020. China is now Russia’s largest single trade partner, with exchanged goods worth USD 104bn in 2020, 19% more than in 2012. Germany comes second with USD 54bn of trade turnover between the two countries, 44% less from 2012.

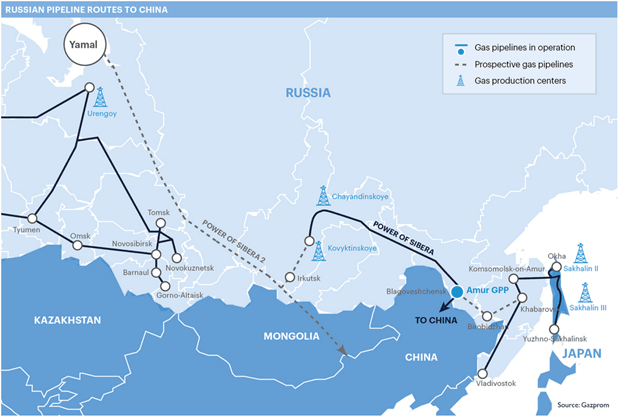

This dynamic is not limited to trade and should accelerate as Chinese corporates are naturally earning dividends from the political alliance between Moscow and Beijing. They represent a growing competition for European companies, especially in areas like infrastructure and transport, with Russia being an important axis of the Belt and Road Initiative. Part of the future Moscow–Kazan highway will be built by the China Railway Construction Corporation. While Nord Stream 2 is under threat, the Russian-Chinese “Power of Siberia” pipeline is approaching full capacity with the construction of a second pipeline “Power of Siberia 2” under discussion . Until now Chinese investments have mostly concerned very large projects, often sponsored by state-owned institutions like the acquisition by Sinopec of a 40% stake in the Amur gas processing plant. This € 200m transaction represented more than 17% of the net FDIs in the country over 2020. It remains to be seen whether they will be followed by more medium-size companies. Russia’s Special Economic Zones have so far faced difficulties to attract Chinese investors and the pandemic is not helping. On his way back from his trip to China, Mr. Lavrov visited Seoul to discuss among other topics the possible establishment of a Russian-Korean investment fund worth USD 1bn, with particular emphasis on joint projects in the Far East and Arctic regions.

Figura 2 - I gasdotti russi verso la Cina

Investing to substitute imports

Russia’s strategy of imports substitution represents another important trend. The country is not self-sufficient in a large number of areas, and in the current environment this dependency is perceived as a weakness. Hence Moscow’s logical attempts to stimulate domestic production. The pork meat sector presents a good case study, with Russia moving from being one of the largest importer in the world to self-sufficiency. In 2020 pork meat exports exceeded imports for the first time, whereas ten years ago imports stood for one-third of domestic consumption. Despite this impressive progress, the country is still very much dependent on imports of genetic material and quality breeding pigs. The later increased by 83% in H1 2020 due to the growing demand from local producers. An interruption of these imports, more than 90% of which came from North America and the EU, would have a devastating impact on Russia’s pork production, retail prices and food security. Substituting imports where it is possible, and more generally diversifying the country’s economy still requires huge investments and transfers of technology.

Investors of the world, unite!

Political tensions have made exports less reliable, as European exporters of agricultural goods have been experiencing following the introduction of the Russian “counter-sanctions” food import ban in August 2014. However any company investing in the country is considered as a domestic investor. The flipside is that European investors no longer benefit from a sort of “honorable foreign status”. They have more interest in presenting themselves as “Russian” companies, which also means that they have to play by local rules. On the one hand, the local business environment has significantly improved according to the World Bank Doing Business ranking, with the country making huge progress from the 120th position in 2010 to become 28th in the world by 2020. This is better than Italy or France, ranked respectively 58th and 32nd. On the other hand, foreign investors will not receive any favorable treatment if things go wrong with a competitor, a local partner or tax authorities.

In February 2019 the arrest of six senior managers from Baring Vostok private equity fund raised serious concerns among the investment community. Since 1994 Baring Vostok has invested approximately USD 3bn in the country and was instrumental behind the growth of some of Russia’s most successful companies like online giant Yandex. This criminal case arose as a result of what has been largely perceived as a corporate dispute with minority shareholders at Vostochny Bank, where Baring Vostok had invested. Its founder, US citizen Michael Calvey, and his five colleagues, nationals from France and Russia, were freed from house arrest in November 2020 but are still facing embezzlement charges. According to former Finance Minister Alexey Kudrin, the Baring Vostok case caused capital flight to double. More recently, in December 2020, the Federal Customs Services launched a criminal investigation against the local subsidiary of H&M, accused of having avoided the payment of customs duties worth USD 42m through license fees. The Swedish clothes retailer counts 155 stores in the country, which represents its 7th market. Possible punishments include jail sentences for senior management.

What are the consequences of these different trends for European companies? Those exporting to Russia should consider investing in the country, which still presents promising prospects in a wide range of sectors ranging from agriculture to industrial equipment, e-commerce or IT. In the 2020 annual survey from the Association of European Businesses, 79% of respondents expressed a positive outlook for the Russian economy over the next 6-10 years. Working hand in hand with local chambers of commerce, national embassies and business ombudsman Boris Titov is increasingly strategic, while building a strong relationship with local authorities is crucial. Attracting investments is part of the KPIs received by regional governors, which has helped to align interests. All in all, the most telling indicator may be Michael Calvey’s statement about his intentions to stay in Russia and continue investing in the country.

Alexandre Kaufmann,

Président du Cercle Franco-Russe

The views expressed in this article belong solely to the author and do not reflect the opinions of his employer or affiliates.

Publié par l'Italian Institute for International Political Studies (ISPI) : https://www.ispionline.it/en/

Comments0

Please log in to see or add a comment

Suggested Articles